SOLD, Thank You

7 Sites Reduced as a Package deal offered at..

Louisiana Opportunity Zoned. Cleared and Ready for Development …

A quiet suburb on the Mississippi River’s West Bank, Algiers Point is a mix of homey pubs, small art galleries and quaint Creole cottages. Visitors cross via the New Orleans Ferry or the Crescent City Connection Bridge for views over to Jackson Square and the French Quarter. Joggers and cyclists follow the levee path, where open-air concerts at the Algiers Ferry Landing draw crowds.

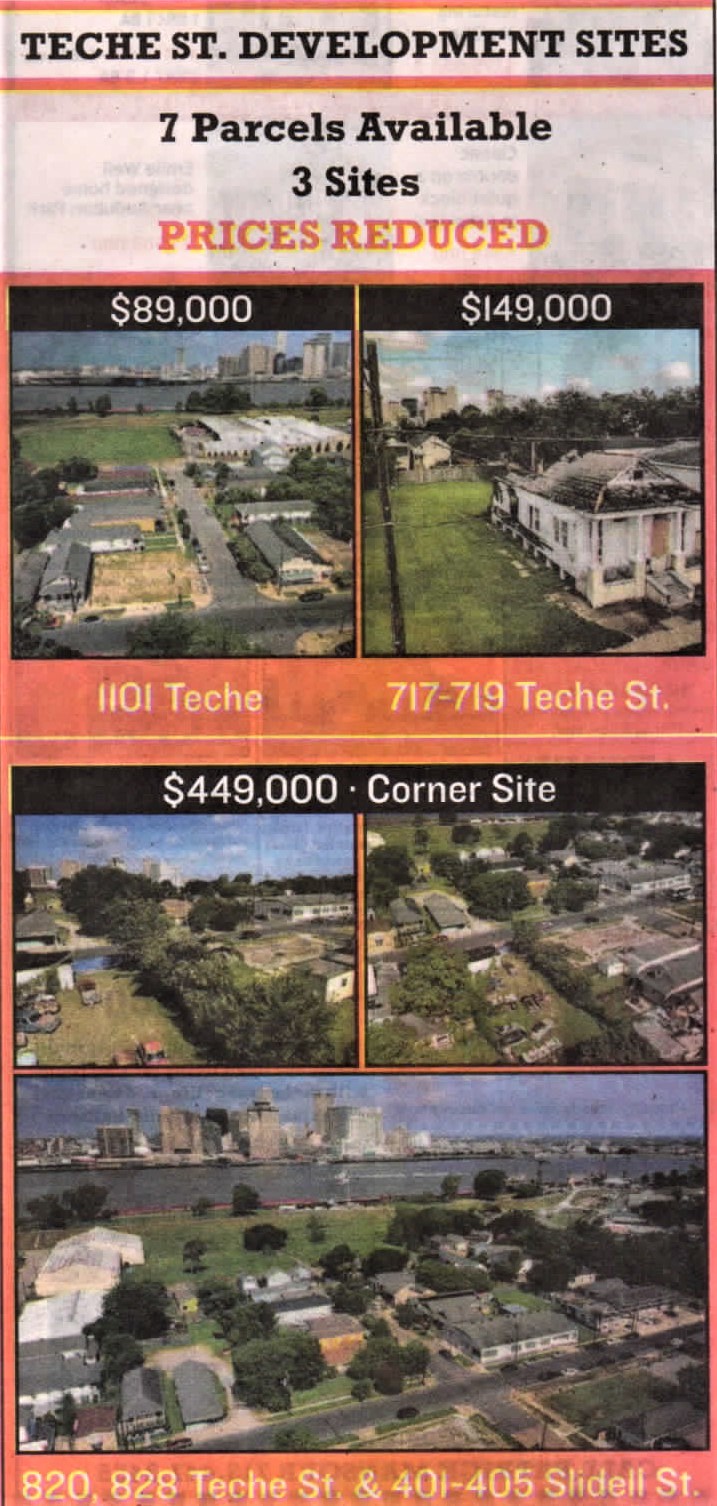

1101 Teche St. Algiers Point, New Orleans, LA 70114

717 Teche St. Algiers Point, New Orleans, LA 70114

719 Teche St. Algiers Point, New Orleans, LA 70114

820 Teche St. Algiers Point, New Orleans, LA 70114

828 Teche St. Algiers Point, New Orleans, LA 70114

401 Slidell St. Algiers Point, New Orleans, LA 70114

405 Slidell St. Algiers Point, New Orleans, LA 70114

Louisiana Opportunity Zone

Through the federal Opportunity Zones Program, banks, communities and others may create Opportunity Funds to direct tax-advantaged investments to federally designated Opportunity Zones in Louisiana. Investors and Opportunity Funds will qualify for favorable federal tax treatment through the U.S. Treasury Department, which will certify Opportunity Funds and their investments. Eligible investments will be those made for ownership of business real estate, capital and other assets by a partnership or a corporation formed for the purpose of investing in qualified Opportunity Zones property.

The primary attraction for investing in Opportunity Zones is deferring and lowering federal taxes on capital gains. For a qualified Opportunity Zones investment, capital gains taxes may be deferred the first five years; after Year 5, taxes may be cancelled on 10 percent of the original capital gains investment and deferred for the remainder; in Year 7 through Year 10, taxes may be cancelled on 15 percent of the original capital gains investment, and the remainder may be deferred through 2026